2024 The Year of Global Elections_FH Korea New Year Newsletter

I trust you have had a year filled with gratitude for this year’s achievements.

In the new year, 2024, the Year of the Blue Dragon,

it is my wish for you to foster a culture of growth for yourself, your people and your organization!

2024 will be a year of global elections, not just the economy.

It is a time to build world-class public affairs capabilities.

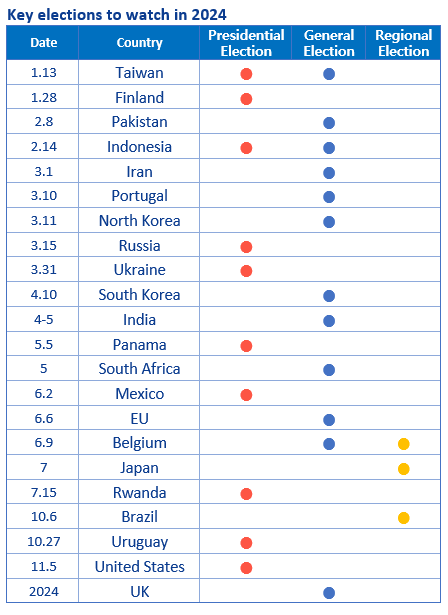

One variable that adds uncertainty to the business landscape in 2024 will be the national elections held in countries around the world. According to The Economist, 4.2 billion people will be voting in more than 70 countries in 2024. In South Korea’s parliamentary elections scheduled for April, many prospective candidates from both the ruling and opposition parties are vying to gain supporters by leaving or creating new parties. Since the outcomes of these elections may substantially affect the regulations and subsidies impacting their businesses, South Korean business leaders doing business in the global market are focused on these many consequential elections.

The global economy remains a concern compounded by the aftermath of geopolitical conflicts and high interest rates. This is why the economy has become a critical factor for voters who are concerned about the rising costs of living, high household debt, and potential loss of jobs due to AI. It is no wonder the 1992 campaign slogan of the former U.S. President Bill Clinton, “It’s the economy, stupid!”, is making a comeback.

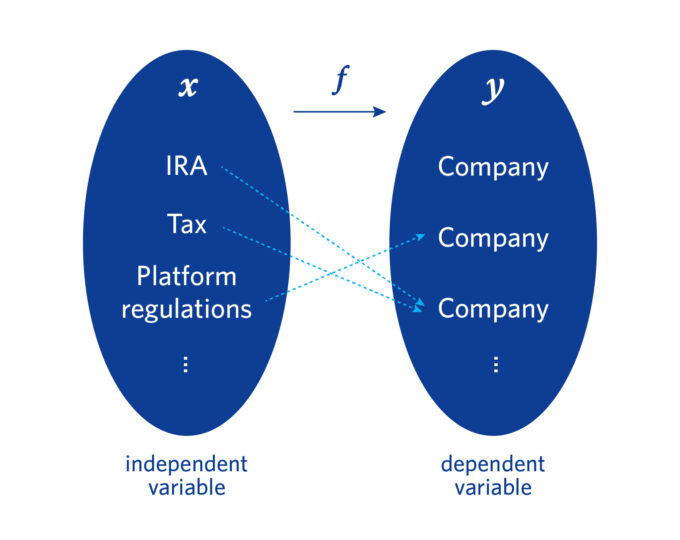

While the economy remains important, it is anticipated that factors such as politics, foreign relations, national security, and so forth will become more significant for the business landscape in 2024. From the perspective of corporations, it can be seen as a situation where “It’s [not] the economy, stupid!” applies. Dependent and independent variables are defined in the equation ‘y = f(x).’ Here, the independent variable, x, determines the dependent variable, y. An illustrative example of this is the situation faced by Korean companies; although they may not be able to influence the outcome of the U.S presidential election, the outcome of this election could significantly affect their fate.

Similar to the U.S. Inflation Reduction Act (IRA), there are many crucial independent variables that could make or break a company: South Korea’s platform regulations, the blanket ban on short selling, the Yellow Envelope Act (a revision to the labor union and labor relations act), the Serious Accident Punishment Act, the minimum wage system, and the weekly work hour system. This year, multiple complex independent variables that can potentially affect the very existence of a company may happen simultaneously. In line with such a forecast, corporate leaders ought to commit to strengthening not only their R&D, marketing, sales, finance, and HR capabilities but also their corporate public affairs capabilities to quickly identify and strategically respond to the changes in the business environment from political and social perspectives.

Concerns over the ‘end of globalization’ amidst major powers’ nationalism

First, it was the Russia-Ukraine war. Then, the Israeli-Palestinian conflict emerged. Now, it is the U.S.-China conflict. There may be no guns involved, but this conflict may be more intense (and perhaps last much longer) than the other two. EU-China tensions are expected to worsen in 2024. These tensions have now escalated into a battle between China, attempting to bypass U.S. barriers to the European market, and the EU, which has decided that it can no longer overlook the trade deficit. The EU-China summit held on Dec. 7 in Beijing was an ‘icy summit’ that symbolically showcased the trade war. Chinese President Xi Jinping and European Commission President Ursula Von der Leyen met but concluded the meeting with little agreement and no joint statement. In June, the EU, with 27 member states, labeled China a ‘systemic rival’ and released a European Economic Security Strategy focusing on measures to reduce its reliance on Chinese supply chains. In October, it launched an anti-subsidy investigation into the imports of electric vehicles from China. Last year, the EU’s trade deficit with China was $426 billion (562 trillion won), higher than the U.S. trade deficit with China of $382.9 billion (483 trillion won). The EU believes that the imbalance in the trade relationship can be attributed to the lack of access for European companies to the Chinese market and preferential treatment of Chinese companies through subsidies. If the investigation leads to concrete actions, such as punitive tariffs on EVs imported from China, China is likely to retaliate in kind.

Meanwhile, the U.S. government recently released proposed regulations providing guidance for what constitutes a ‘Foreign Entity of Concern’ (FEOC) under the Inflation Reduction Act (IRA). These terms would apply to China, effectively excluding the country from the U.S. battery supply chain. The rules are set to come into effect in 2024 for battery materials and in 2025 for critical minerals used in their production. In short, the provision disqualifies vehicles with parts or minerals sourced from FEOCs from being eligible for the EV tax credits (subsidized up to $7,500 per new electric vehicle). There is a problem with this. As China accounts for 60% -70% of the global production of graphite, cobalt, nickel, lithium, and other key minerals, South Korean battery producers will be affected by the regulation as well. Procuring minerals from China has become more difficult and costly, and forgoing the tax credits to enter the U.S. market is not a viable alternative. South Korean businesses may be stuck between a rock and a hard place. As over 100 battery companies are currently publicly traded, this could lead to a severe problem for the entire South Korean economy.

Even more shocking is the report issued by the Select Committee on the Chinese Communist Party at the U.S. House of Representatives. The report called for the revocation of China’s Permanent Normal Trade Relations (PNTR), which were enacted upon China’s acceptance into the WTO in 2000. The report also called for active measures to deter China from monopolizing the global semiconductor industry. Overall, the Select Committee pushed for a hardline policy toward China. If some of the recommendations in the report are enacted, we can expect complete chaos in the global economy and trade order. Of course, China will not stand by idly in such scenario.

One of the key industrial policy directions for China last year was the “parallel pursuit of development and security.” The word ‘security’ seems rather out of place in industrial policy directions. It reads as China’s intentions to take into account national security when devising industrial policies. More specifically, it hints at further protective measures in China’s trade war with the U.S. One instance of these protective measures can be that China established China Rare Earth Group Co. Ltd., a state-owned enterprise, to directly supervise the production and supply of rare earth elements. Just as the urea shortage crisis in diesel production just a while ago left the Korean economy in shock, if China tightens regulations on rare earth exports, the worldwide impact would be dire.

For global companies seeking growth opportunities, they cannot ignore China. However, China is entering a new phase of development, transitioning from high growth to sustainable growth. U.S.-China tensions continue to impact the outlook for the Chinese economy, and global companies operating in China must choose the right battlefield and adapt to the new era to mitigate risks.

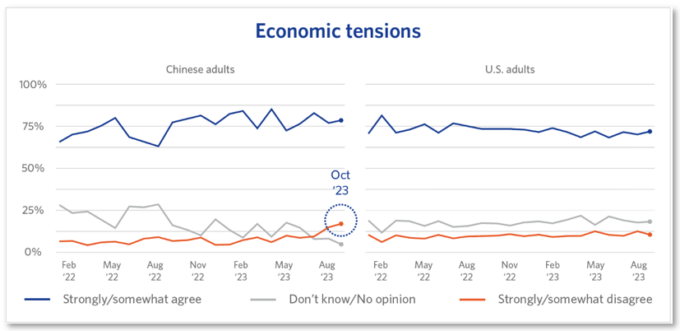

According to Morning Consult’s “U.S.-China Relations Barometer” research, the majority of Chinese and U.S. adults have expressed concerns about bilateral economic tensions and believe that the U.S. and China should work together to reduce these tensions. However, the proportion of Chinese adults who disagree with this view has recently risen.

Source: http://The State of U.S.-China Relations: H2 2023 Report

Source: http://The State of U.S.-China Relations: H2 2023 Report

Recently, the Japanese government has also decided to establish a new tax system to promote domestic production of strategic goods. To be announced within the 2024 Tax Reform Outline, the government plans to reduce corporate taxes by 20% to 40% for companies that produce electric vehicles, batteries, and semiconductors in Japan. It is called the ‘Japanese IRA,’ as it is modeled on the U.S. IRA.

As the great powers race to bolster the interests of their own countries first, ideals of world peace and humanity’s common good are being swept aside. Some have even called this era the ‘end of globalization.’ The period between the late 20th and early 21st century can be viewed as a time when the world revolves around the United States, following the collapse of the Soviet Union and the end of the U.S.-Soviet Cold War. For corporations, the next chapter signifies the end of an era when businesses could sell their products anywhere in the world as long as they were cheap or well-made. This could mean the ‘collapse of the global supply chain’ as designed based on the theory of comparative advantage. This is devastating for an outward-looking country like South Korea, which relies on foreign countries for both exports and imports. As the logic of power dictates the race to set standards and pre-empt them, it is hard to tell what new regulations and new trade barriers will suddenly appear until the race is over.

The 28th Conference of the Parties (COP28) to the United Nations Framework Convention on Climate Change (UNFCCC) held in Dubai was emblematic of how difficult it has become to reach consensus among nations, even on global issues. The 198 member states negotiated through the night, even pushing back the scheduled closing date by a day. While they did adopt the United Arab Emirates Consensus, the outcome was seen as a step backward from previous COP meetings. This was because the final agreement chose the phrase “transition away” from fossil fuels (the main culprit of global warming) instead of “phase-out” or “reduction.”

Taiwan’s elections in January will determine whether the Democratic Progressive Party (DDP), which has been in power for the past eight years, will succeed in retaining the presidency or whether the Kuomintang (KMT) will regain power. The DPP is pro-U.S. and the KMT is pro-China. Consequently, the result of the election will have a major impact on Taiwan’s diplomacy, which is the reason why Taiwan’s election is often referred to as a proxy for the U.S.-China conflict. The cross-strait relationship between China and Taiwan is already a source of tension around the world. In fact, the Hoover Institution at Stanford University has gone so far as to say that “Asia is in its most dangerous moment.”

In March, the warring nations of Russia and Ukraine will both hold elections. Although a change in leadership is unlikely due to the war, the public sentiment expressed during the elections will impact whether the war continues. As a result, the election will also be a major factor in global price fluctuations and the supply and demand for energy and grains.

In the European Parliament elections to be held in June, far-right parties are expected to win many seats. If this happens, Europe will likely become more protectionist in its tariffs, immigration policies, etc. Already, far-right parties have come to power in Italy, Finland, and Switzerland on the back of anti-immigrant sentiment. In Austria, Belgium, Portugal, and Romania, far-right candidates are leading in the upcoming general elections.

In Poland, which held its general election last October, the new government immediately declared that it would “review all contracts made by the previous government from scratch.” For South Korea, this could mean a major roadblock for K-Defense, which has been thriving. However, depending on how these companies respond, this could be the start of a new era for K-Defense.

The Liberal Democratic Party (LDP)’s presidential election in Japan, scheduled for September, is worth watching. Recently, four ministers from the Abe faction, the largest faction within Japan’s LDP, were reshuffled. While the outcome remains to be seen, it is anticipated that the government will continue its initiatives to make Japan: i) an investment-oriented nation open to foreign investors from ‘like-minded’ countries, ii) the leader in Asia in achieving net-zero emissions before 2050 through feasible technological innovation and collaboration with other Asian countries, such as hydrogen and ammonia co-firing, iii) a more productive country by promoting digital transformation in both the public and private sectors.

However, the most important variable will be the U.S. presidential election in November. Many globally are already voicing concerns over the impact of a Trump victory. The stakes are different for different countries. If Trump comes to power again, legislations such as the Biden administration’s Inflation Reduction Act (IRA) could be wiped out. If the bill is repealed, so are the subsidies. Korean companies that have built factories in the U.S. reliant on these subsidies would be hit hard. Inter-Korean relations would also change dramatically. Trump is also against supporting Ukraine. Many countries like South Korea that have sided with Ukraine may be forced to turn their backs. Relations with China, in particular, could deteriorate further, and South Korean companies may be caught in the crossfire.

Both the United States and China are important economic partners for South Korea. In a geo-political environment where economy and security are inseparable, the administration will likely maintain its big-picture diplomatic stance. At the same time, many are urging that South Korea, as an advanced trading nation, should de-risk through diversification while pursuing inclusive policies in both foreign and domestic markets. With the center hollowed out, confrontations and divisions between conservative and liberal ideologies, men and women, generations, regions, and income groups are likely to intensify leading up to the general election. Corporations will need a high degree of tact and fine-tuning to navigate the risks of changing global strategies and local policies in the complex global environment.

In such times of uncertainties, what should the business leaders do?

First and foremost, business leaders should put up a ‘Map of Stakeholders’ on their office wall. There are countless stakeholders in the corporate environment: employees, suppliers, shareholders, and customers. There are also the government, the national assembly, unions, NGOs, and your competitors in the market. If your company imports or exports goods, or is involved in any way with importing and exporting, the map might expand to include your overseas stakeholders. It is essential to know the recent trends in the global trade market, not to mention the various laws, regulations, systems, and different standards. Since these issues are constantly evolving, you may need to regularly monitor them to keep up with the latest information. All the graphs and charts (such as the company’s sales, profits, defect rates, number of employees, and company organization chart) that used to be up on your wall last year can now find their new places in the COO’s office this year.

Next, you ought to practice ‘simulation management.’ In 2024, the business environment could be defined as one in which ‘risk mitigation’ is a daily calculation. Therefore, developing a precision scenario planning approach supported by data and intelligence will be necessary to avoid disruptions to operations. In times of uncertainty, the wise are the ones who humbly consider all possibilities. There is not just one independent variable, x, but rather, there are x1, x2, x3, and so forth, which could make the situation all the more complex and challenging. Many companies in Korea have succeeded by providing products and services made with top-notch technologies and innovations. What is needed is to add ‘shrewd insight’ that can be appropriately applied to unexpected crises and when responding to unforeseen changes in organization, infrastructure, and policies. To achieve sustainable growth, you will need to upgrade your compliance system, communication with your stakeholders, and corporate culture to a world-class level, ensuring readiness for social and cultural risks. Keenly observing the changes around you and running a simulation that takes into account various independent variables and their interactions, based on your insights, is desperately needed. You may need to consider all cases and options and plan out strategies for all the different scenarios. This is quite different from emergency management. Emergency management entails contingency planning in case of an emergency, while simulation management assumes various scenarios and cases from the start and devises a different countermeasure for each scenario and case.

In addition, you must be prepared to communicate and engage effectively and timely on your position regarding challenging questions related to various election agendas that are important to voters. These agendas include topics such as labor, workplace safety, digital platform service fees, data governance, and more. It will be essential to take into account stakeholders’ interests, positions, and perceptions while aligning with the company’s long-term ESG (Environmental, Social, and Governance) strategy and DE&I (Diversity, Equity, and Inclusion) values.

Lastly, it will be necessary to secure a pool of professionals in your own network whom you can trust and reach out to for help. The process of identifying the problem may be tough, but once you get your head around the problem or a potential problem, it will become much easier to manage it. This process requires monitoring and sensing, and this is where your professionals could come in to help. You can never receive too much consulting and mentoring from academics, researchers, professional firms, and other experts who are knowledgeable in the field.

At the end of 2023, there was a Schopenhauer craze in bookstores. Among Schopenhauer’s quotes, there is one that goes, “Every person takes the limits of their own field of vision for the limits of the world.” Leaders ought to be aware of this and acknowledge that there may be things they cannot see, which can lead to making judgment errors based on past experiences of success.

“Contemplate, ask again, and look the other way.” This adage, imparted by Henry Kissinger, who recently passed away at the age of 100, is a lesson for CEOs and leaders of our era. He was a legendary figure in U.S. diplomacy, renowned for his monumental role in bridging U.S.-China relations. Oriana Fallaci, an acclaimed journalist who interviewed Henry Kissinger in 1972, echoed these sentiments. It is essential to have someone who can see things from a different angle, identify blind spots you may have missed, and provide insights and solutions to help navigate through times of uncertainty.

Yvonne Park

President, FleishmanHillard Korea

FleishmanHillard’s global Public Affairs team can support you

in navigating issues and stakeholders, as well as identifying effective ways

to engage in managing reputational and regulatory risks during this election year.

PDF download: 2024 The Year of Global Elections_FH Korea New Year Newsletter

Find Out More

-

Adaptability the new imperative with tariff deal

August 5, 2025